Latest fraud alerts

Package delivery or rearrange scam texts and emails

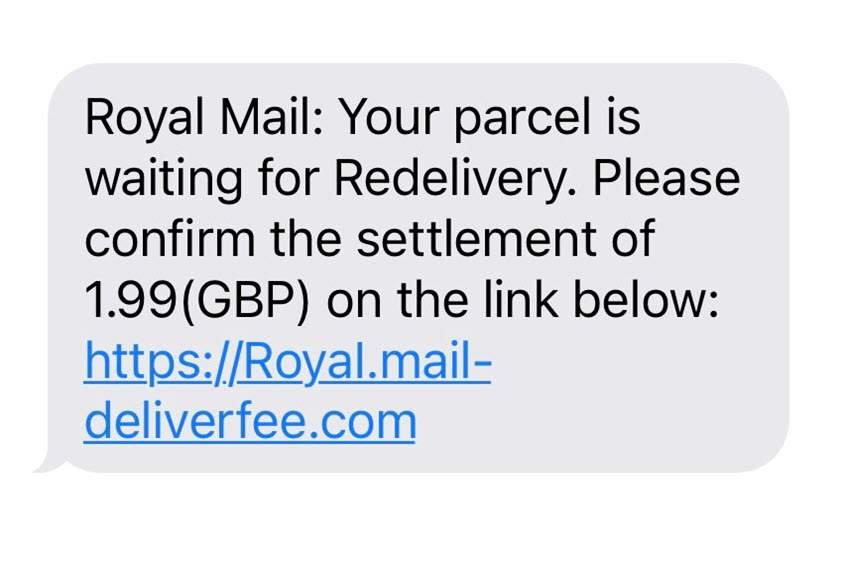

Fraudsters are targeting customers through texts and emails claiming to be delivery companies such as Royal Mail or DPD. These texts/emails are trying to obtain personal details and/or account security information. Please be vigilant and don’t click any links or disclose any information.

Below is an example of a scam text you may receive:

Regardless of how professional or convincing a caller sounds, remember, the bank, police, Royal Mail or other trusted organisations will never:

- Ask for your financial information or your security details in full

- Ask you for your PIN code, verification codes or token codes

- Ask you to move your money to a new or ‘safe’ account.

If you are given any of these instructions, it is an attempt of fraud.

If you believe you are a victim of fraud please contact us immediately.

Important customer reminder

Scam artists continue to target customers via texts, emails and phone calls, claiming to be from trustworthy organisations (such as the police, or your bank). Fraudsters will try and use these modes of communication to obtain your confidential information and account details.

Your bank, the police or any other trusted group will never:

- Ask for your financial information or your security details in full

- Ask for your PIN code, verification codes or token codes

- Ask you to move your money to a new or ‘safe’ account

- Send you an email, text or social media message containing a link to a login page

Please read our advice on how to use Third Party Provider (TPP) services safely.

If you are asked for any of the above, you are likely talking to a scam artist.

If you fear you have fallen victim to fraud, please contact us immediately.

The FCA warns of online scams in cryptocurrencies such as Bitcoin

Consumers are being urged to be vigilant towards investment scams that may be advertised on social media, including sites such as Facebook, Twitter and Instagram. The fraudulent adverts are offering investment into cryptocurrencies such as Bitcoin, as well as binary options, contracts for difference (CFD), and forex.

The adverts link to websites and profiles which appear to look professional, but are in fact fraudulent brokers and firms who manipulate and distort prices and are not authorised by the UK’s Financial Conduct Authority (FCA).

If you deal with an unauthorised firm you also won’t have access to the Financial Ombudsman Service or Financial Services Compensation Scheme (FSCS) if things go wrong.

To reduce the chance of falling victim to investment fraud:

- Never respond to unsolicited investment offers whether made online, on social media or over the phone.

- Before investing, check the FCA ScamSmart pages to see if the firm or individual you are dealing with is authorised. You can also check the FCA Warning List which details firms to avoid.

- We recommend you seek impartial advice before investing.

For additional information on how to choose a financial adviser, please visit:

You could avoid investment and pension scams by being ScamSmart. Further advice and guidance from the FCA can be found on their ScamSmart pages.

Warnings of an increase in text scams

Text message scams are on the rise, say Financial Fraud Action UK. Texts which look like they are from your bank may claim there is fraudulent activity on your account, or ask you to verify your account or security details in full.

Special software can make a text look like it legitimately came from your bank, and may even be included in an existing message thread on your phone.

Be suspicious of messages which ask you to click on a link, call a telephone number to verify account activity or ask you to divulge security information or your full account details.

If you have any concerns relating to fraud, contact us immediately.

Read more about text scams on the Financial Fraud Action UK site.

‘Binary options are being used for investment scams’ say fraudsters

A binary is something relating to, or made up of, two things. You may have heard of ‘binary options’. These are financial options where there are only two possible outcomes: win or lose. You bet on the price of something, such as whether stocks will rise or fall: get it right, you make money - get it wrong, you lose money. Crucially, you aren’t buying what you are betting on - so you don’t get the stocks, or oil, or whatever it is. You simply bet on it.

Fraud occurs when one of these Binary Trading Platforms:

- Refuses to credit a customer’s account

- Breaks off all contact with the customer

- Distorts the price of what you are betting on

- Offers a higher than average return on an investment.

Scammed customers are thus left unable to withdraw their winnings (if they have any) or any funds they deposited.

A convicted fraudster recently told the NFIB Proactive Intelligence Team that “binary options are the new investment scam. Platforms are set up all the time to appear legitimate, but are actually fake.”

They said that “companies operating these fake Binary Trading Platforms make 100% profit - a percentage of which goes to the brokers and the remainder to the rest of the company. Victims who invested never see any returns and when the customers attempt to withdraw funds it’s made very difficult for them to do so. At times, the company ignores them completely, ceasing all contact.”

Stay protected

- Too good to be true? It probably is. Don’t invest in something you don’t trust.

- Be wary of unexpected ‘investment opportunity’ calls. If you’re worried, just put down the phone. Don’t indulge them just to be polite.

- If you do not trust a firm offering binary options, don’t give them your bank details and do not transfer and money to them.

For more information on binary options scams, visit the Action Fraud webpage.

Fear you have fallen victim to fraud? Contact us immediately. Also contact Action Fraud by calling +44(0)300 123 20 40 or by using their online reporting tool.

Loan fee scams

A loan fee scam is when you are asked to pay an upfront fee when applying for a loan or credit. Once the payment has been made, the lender will not pay out the loan or credit amount but keep the initial fee.

We have been made aware by the Financial Conduct Authority (FCA) of an increase in the number of reports from consumers who have been affected by loan fee scams.

Scammers target the most financially vulnerable in society, people who are on lower incomes and with low credit ratings. You can learn how to spot the warning signs and protect yourself by visiting the FCA website.

Report fraud

Scams can be sophisticated. If you fear you’ve fallen victim to fraud, call us immediately on:

- +44(0)3457 212 212 – for current account customers

- +44(0)345 600 6000 – for credit card customers

- +44(0)3457 213 213 – for business banking customers

Please note, calls to these numbers will be charged. See call charges.

Report a scam or potential scam

Call 159 — this service quickly redirects you to your bank, so you can report scams and suspected fraudulent contact.

Find out when you should call 159

Fraudsters will sometimes send fake emails claiming to be from trusted organisations. If you suspect a smile email of being a scam, please let us know by forwarding it to ihaveseenascam@co-operativebank.co.uk

Along with other UK banks, we have made a commitment to UK finance and the FCA to protect our customers from fraud. View our approach to fraud prevention (PDF).

Question a transaction

If you disagree with a payment on your account, there are a few different options you can take, depending on whether you think it’s fraudulent or genuine.

Verification codes

We use verification codes as an additional layer of security when you’re doing things like logging in to online banking, making online banking payments or setting up new payees.

To make sure it’s always you using your online banking account and nobody else we’ll send you a code and you then need to follow the instructions online to enter the code.